5 Tips on How to Be a Successful Female Entrepreneur

Swyft Filings is committed to providing accurate, reliable information to help you make informed decisions for your business. That's why our content is written and edited by professional editors, writers, and subject matter experts. Learn more about how Swyft Filings works, our editorial team and standards, what our customers think of us, and more on our trust page.

Swyft Filings is committed to providing accurate, reliable information to help you make informed decisions for your business. That's why our content is written and edited by professional editors, writers, and subject matter experts. Learn more about how Swyft Filings works, our editorial team and standards, what our customers think of us, and more on our trust page.

“Making the decision to not follow a system, or someone else’s rules, has allowed me to really dig into what my own strengths and gifts are without spending time feeling jaded or wasteful.” – Ishita Gupta, founder of Fear.less Magazine

The most successful female entrepreneurs face heavy challenges and sacrifices, as all entrepreneurs do. They combat sexism, anxiety from entering a male-dominated and unfamiliar territory, and, although most women hate to admit it, the maternal guilt that follows leaving child(ren) at home while they cater to their other child—the business. However, most of the obstacles that women entrepreneurs face are not related to gender differences.

Common Challenges for Female Business Owners

In 2017, only 17% of startups in the U.S. were founded by females. Why is this a trend that sees little-to-no improvement? Here are a few reasons why:

Funding

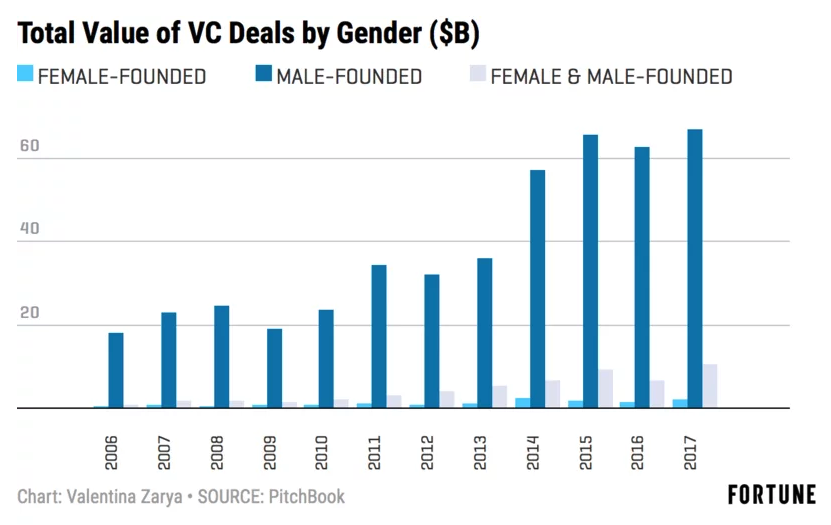

In the world of venture capital, there is a clear gender gap for funding. In 2017, female founders reported that they received only $1.9 billion of the total $85 billion invested by venture capitalists last year. This was better than the $1.4 billion that the founders received the year before, but still averaging only 2% of total investments.

Work-Life Balance

The stigma that women are restricted to domestic life in order to care for the children and household has diminished over the years. Nonetheless, there’s still a cycle of stress that follows balancing family and a business. A business requires more work hours than a normal 8-5 job in order to hit milestones and support a family; but relationships also require hours to stay healthy, happy, and secure. This is not including the entrepreneur’s personal time for mental and physical health.

General Startup Issues

Then there are the additional hurdles that are common amongst all entrepreneurs, such as competitive markets, legal disputes, managing cash flow, cultivating a network—anything pertaining to keeping the business afloat in those first few years.

5 Tips for Women Entrepreneurs�

Most of this advice is not gender-specific… and that’s the point! To put these tips into perspective, we interviewed Chef Mary Bass. Chef Bass has run her own bakery for over four years, was a finalist on Food Network’s Cutthroat Kitchen, was recently appointed to be the executive chef of Katie’s Seafood House, and also works with several non-profit organizations within her community. After speaking with Chef Bass, it is clear that she has an entrepreneurial spirit, and far exceeds the expectations of most female entrepreneurs.

#1. Stay Balanced, Healthy, and Happy

Your mental and physical health comes first. Remember that if you can’t take care of yourself, how can you manage anything else? There are multiple ways to encourage a balanced and happy life, most of which require splitting your time for family, the business, and self-care. When one role overflows into the other, you might experience undue stress, and both the family and the business are exposed to emotional tension. Set up a consistent, but flexible schedule to keep parts of your life separate. Flexibility is recommended to fit any emergencies that either your family or your business might need.

An additional tip would be to schedule out time that connects your family with the community, extended family, and close friends to ensure that they are fully supported. That’s exactly what Chef Bass did—she made sure she could raise a strong and independent household, and also utilized the community around her during the times she couldn’t be present.

“I don't think that women should have to choose. Like I raised very independent, strong willed children. I have two boys and two girls and they are all amazing humans because I said, 'You know what? Mom's going to work mostly because I want to live a certain lifestyle',” said Chef Bass. “I have the ability to be so successful and be able to do all the cool things I get to do because I have all these people who surround me and help me out.”

#2. Have Grit

Grit is the passion and resolve of a person—the ability to persevere when a conflict arises. Rejection and pessimism are inevitable for new business owners. Female entrepreneurs specifically need the grit to overcome gender inequality.

Chef Bass did not acknowledge gender disputes in her career. “I didn't allow people to say, ‘No, you can't do this because you're a girl.’ It just wasn't even something that entered my thought process.”

#3. Connect with your Community

Depending on your business, reaching an audience results in broadening your customer base and network. If you plan to expose your business to a national audience, utilize social media to share your success and business endeavors. If your business is local, get involved in your community. Chef Bass does both.

“There's a lot of people who are at [a chef pop-up event] that don't even know who I am, and I earn and meet new customers that way. It gets me more followers and I'm very social, so I'm like, ‘Hey, make sure check in on Instagram and tag us in it,’ encouraging them to utilize social media to promote our business.”

After the tragic mass shooting at Santa Fe High School in Santa Fe, Texas, Chef Bass organized a free dinner for residents at the Santa Fe Community Center. She is also the founder of the Chef’s Table Charities non-profit organization and preparing for a holiday event.

“Our goal is to raise $50,000. The nonprofit allows me to do a lot of really cool things within the Galveston County community.”

#4. Stay Creative, Informed, and Adaptable

Knowledge about your industry, the most updated market trends, and anything that could potentially affect your business are all crucial information. Although it is easier to create a standard process for your business, refusal to stay creative and adapt to change is one of the biggest mistakes that entrepreneurs can make.

“Sometimes I just get bored, which I try to stay busy enough where I don't do that because I typically get in trouble whenever I get bored. I ended up creating whole new businesses or coming up with something, but that's just being an entrepreneur, so just try to always push yourself.”

#5. Check if Your Business is Eligible for Additional Funding

Some entrepreneurs like Chef Bass are able to self-fund their businesses and avoid seeking outside grants or investors. Others are not so lucky. When in doubt, here are a few small business grants available for women entrepreneurs:

Any loans or grants available at your nearest

Women and men experience generally the same startup challenges. By focusing on the goal, balancing your life, utilizing the network around you, and making good business decisions, success will follow… and that’s all that really matters in the end.

“I'm going to be the best because I am who I am. And just take that mindset—it's setting you up for success from the get-go.” – Chef Mary Bass.

Mary Bass is a native Galvestonian and BOI with deep roots in the community. After completing her AAS in Culinary Arts and Hospitality Management at Galveston Community College, she went on to open and run her own bakery for more than 4 years. She was offered a position working for Haak Vineyards and Winery in 2013 as their Executive Chef. While there she was featured in many local magazines and news outlets including Houston Press, Galveston Daily News, and Coast Magazine. In April 2015 she signed on as the Executive Sous Chef of BLVD. Seafood, recently named "Best New Restaurant" by Galveston.com. All the while teaching classes for kids and adults at a local kitchen store, Kitchen Chick. She just entered her sixth year of teaching culinary arts as an adjunct instructor at Alvin Community College. Chef Mary Bass is available for private and public events of all types offering a fun and outgoing personality with a wide variety of knowledge in the culinary field.

Related Articles:

Swyft Blog

Everything you need to know about starting your business.

Each and every one of our customers is assigned a personal Business Specialist. You have their direct phone number and email. Have questions? Just call your personal Business Specialist. No need to wait in a pool of phone calls.