Key Takeaways

Every business, including LLCs, corporations, and nonprofits, is required to have a registered agent in every state where it operates.

A registered agent receives legal and tax documents on behalf of your business and ensures the timely delivery of important notices.

You can be your own registered agent, but it comes with downsides like privacy concerns, missed legal notices, and the need to be present during business hours.

Did you know that over 470,000 entrepreneurs filed business applications in August 2025 alone?

Of those, approximately 28,725 are projected to become employer businesses within the year. But many won’t survive their first compliance challenge.

The #1 reason?

Missed registered agent notices.

If a business is sued and its registered agent is unreachable, the business may never learn about the lawsuit.

The business automatically loses by default.

This is called a “default judgment,” and it can result in:

- Wage garnishment

- Asset seizure

- Personal liability

This comprehensive guide will walk you through the registered agent requirements in all 50 states and provide actionable tips to protect your business.

What Is a Registered Agent and Why Do You Need One?

A registered agent is someone (or a company) who receives essential legal and tax documents on behalf of your business. These documents include:

- Service of Process (lawsuits and court summons)

- Tax Notices (income taxes, sales tax, franchise taxes)

- Compliance Reminders (annual report deadlines, renewal notices)

- Government Correspondence (state agency letters, permits, regulatory notices)

Why Is a Registered Agent Required For LLCs And Corporations?

Every state requires that businesses like LLCs, corporations, and nonprofits appoint a registered agent before incorporation or formation is complete. The two primary reasons for appointing a registered agent are:

- Legal notice: The registered agent is the official point of contact for lawsuits, tax notices, and other vital state communications.

- Public record: It ensures transparency and accountability as required by state law.

The Secretary of State will reject your business filing if you don’t designate a registered agent. Make sure you have a valid registered agent listed before submitting your business registration.

Registered Agent Requirements: The Universal Standards Across All 50 States

The basic requirements for a registered agent in most states are similar, regardless of where your business is located. Here is what you need to know:

Requirement | What It Means | Why It Matters |

Age (18+) | The registered agent must be at least 18 years old | Minors cannot accept legal services |

Physical Address (No P.O. Boxes) | Must have a street address, not a mailbox service | The state needs an office location to serve documents in person |

State Residency or Authorization | Individual agents must live in the state OR be a registered business entity operating there | Out-of-state residents cannot be registered agents |

Regular Business Hours | Must be available Monday-Friday, 9 AM - 5 PM (or equivalent) to accept documents | If the agent is not available, some states automatically serve the Secretary of State |

Public Record Disclosure | The agent’s name and physical address appear in the state’s public business registry (searchable online) | Anyone, including competitors, can find this information |

State-Specific Requirements

Can I Be My Own Registered Agent? The Honest Pros & Cons

You can serve as your own registered agent in most states. Here are the pros and cons:

The Pros

- Cost savings: $0 upfront

- Direct control: You are the point of contact

The Cons

- Your address becomes public record, which is searchable on the Secretary of State’s website. This leads to:

- Junk mail

- Predatory lending offers

- Competitors finding your home address

- Personal safety concerns

- Process servers deliver lawsuit papers in person.

- You must be physically present at the listed address during all business hours. This means:

- No client meetings off-site

- No coffee shop work sessions

- No mid-day gym breaks

- No vacations without risking non-compliance

- If you register as a foreign LLC in another state, you need a physical address there. You can’t be your own agent in multiple states simultaneously.

What Happens If You Don't Have a Registered Agent?

Here are the key consequences:

Missed Legal Notices

You won’t receive lawsuits, summons, or other critical legal documents. A judgment may already exist against your business, and you may not discover it. This can lead to wage garnishment, asset seizure, and legal fees to overturn the judgment.

State Penalties

States impose fines, often annually, for non-compliance, which can add up quickly.

Loss of Good Standing

Your business can be administratively dissolved or suspended by the state. You can’t:

- Get a business loan

- Close deals requiring good-standing certificates

- Expand into other states

- Secure government contracts

Privacy Risks

You might have to use your home address, which can expose your personal information publicly and risk identity theft.

How to Change Your Registered Agent

Step 1: Choose Your New Registered Agent

Confirm:

- They serve your state (s)

- Pricing fits your budget

- They offer same-day document scanning

- They provide compliance alerts

Step 2: Notify Your Current Agent

Most states require informing your current agent before a change.

Step 3: File Change of Agent Form

File with your state’s Secretary of State:

- Form name: "Statement of Change of Registered Agent" (varies by state)

- Fee: Varies by state

- Processing: The time duration depends on the state

Step 4: Update Your Records

- Notify your bank (some require registered agent info on file)

- Update vendor contracts

- Update business licenses requiring agent information

Step 5: Confirm Acceptance

Your new agent should send confirmation within 24-48 hours. Verify their address appears correctly on the state’s business entity search.

Pro Tip: Swyft Filings handles the change in paperwork for you as part of our service.

Multi-State Entity? Here's What You Need to Know

You will need a registered agent in each state if you register as a “Foreign LLC” in multiple states. This creates complexity:

Option 1: Use a National Provider

- Best for: Founders with 3+ states

- Advantage: One dashboard, one point of contact, consolidated compliance alerts

- Top Pick: Swyft Filings (specialist review across all states)

Option 2: Use Individual State Agents

- Best for: 1-2 states

- Advantage: Potentially cheaper for 1-2 states

- Disadvantage: Multiple logins, inconsistent scanning quality, separate compliance alerts

Foreign Qualification Requirements

When you “foreign qualify”, you must:

- Get a certificate of good standing from the home state

- File foreign qualification paperwork in the new state

- Appoint a registered agent in the new state

- Pay foreign qualification fees

NOTE: Each state requires a separate agent with a physical address in that state.

How to Choose a Registered Agent Service

Use this checklist to choose a registered agent service:

Must-Have Features

- All 50 states coverage (if you plan to expand)

- Same-day document scanning (not 1-2 business days)

- Digital dashboard with mobile access

- Compliance monitoring (annual report reminders, franchise tax alerts)

- Free agent changes (if you need to switch later)

- Privacy protection (uses their address, not yours)

- U.S.-based support (not outsourced)

- No hidden fees (transparent pricing)

Red Flags That Signal a Bad Agent

- Charges per document scanned

- No compliance monitoring (just a mailbox)

- Requires a 90-day notice to cancel

- Outsourced support to call centers

- No online dashboard (send mail only)

- No refund policy

- BBB complaints about missed documents

Why Swyft Filings Is the Smart Choice?

1. Three Simple Steps to Get a Registered Agent

Here is a three-step process to get a registered agent:

- Choose your state(s)

- Our team of compliance specialists will review your details and handle all the filing with the state

- Receive official notices, scan them, and upload them to your secure online account for quick access

2. Specialist-Reviewed Filings

Every registered agent appointment is reviewed by a business formation specialist before filing. This catches errors that could reject your filing or leave you non-compliant.

3. Live Expert Support

Our specialists are available to answer questions and review your details. For example, one customer had two issues that needed immediate attention. The issues were resolved quickly and professionally.

4. Proactive Compliance Monitoring

We receive documents and alert you 60 days before annual reports are due, track franchise tax deadlines, and send multi-state compliance calendars.

5. Same-Day Document Scanning

Legal documents are scanned and uploaded to your secure dashboard within four business hours. If it is urgent, we will call you directly.

6. All 50 States, One Dashboard

Whether you have one LLC in Texas or foreign qualifications in 12 states, manage everything from a single login. No juggling multiple providers.

Ready to Protect Your Business? Here's What to Do Next

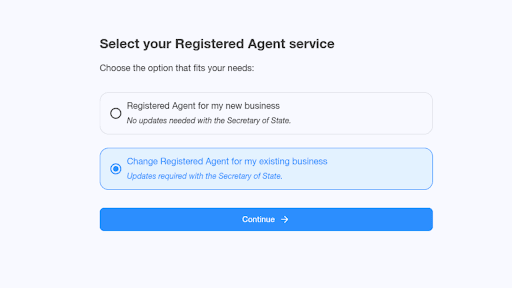

Step 1: Go to the website (https://www.swyftfilings.com/registered-agent/) and click “ Get Started”.

Step 2: Choose the option that fits your needs.

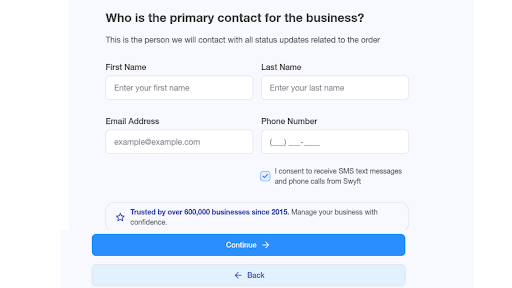

Step 3: Fill out the details regarding the primary contact for the business.

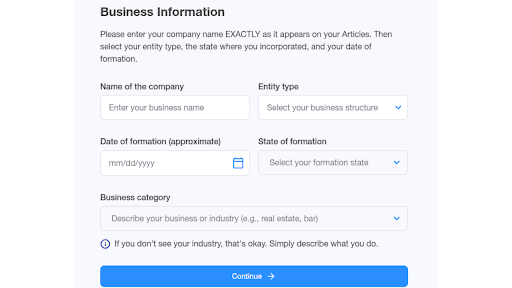

Step 4: Enter your business information. Make sure it is factually correct.

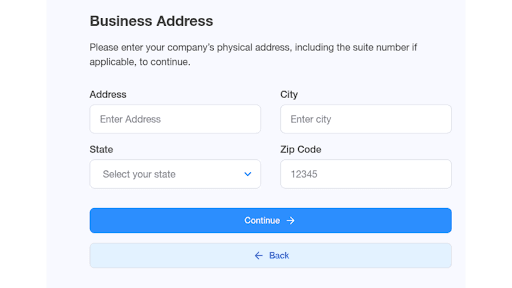

Step 5: Please enter your company’s physical address, including the suite number if possible.

The process is simple and will be completed instantly. If you have any questions, our business formation experts are available 7 days a week over the phone (877) 777-0450 or chat.

Frequently Asked Questions (FAQs)

1. Do I need a registered agent in every state I do business in?

Yes, each state requires a registered agent with a physical address in that state. You will need coverage in each state if your business expands into multiple states.

2. Can I change my registered agent anytime?

Yes, you can change your registered agent by filing the proper form with your state. Swyft Filings can help you by making the process simpler.

3. What happens if my registered agent resigns?

If your registered agent resigns, then you must get a new agent quickly.

4. Is a registered agent required for an LLC?

Yes, in all 50 states. This is a non-negotiable requirement for LLCs, corporations, nonprofits, and LLPs.

5. Can I use a virtual office or mailbox service?

No, in most states. Registered agents must be physically present to accept service of process. Virtual offices and P.O. boxes are rejected.

6. How much is a registered agent service?

The cost of a registered agent service can vary based on the provider and the level of support included. It is important to check out the reputation of the service's reputation before making a decision.