Trustpilot

Launch Your S Corporation with Confidence

Protect your personal assets and reduce your self-employment taxes. Our specialists review every detail for accuracy and compliance.

- Reduce Self-Employment Taxes

- Avoid Double Taxation

- Keep More of What You Earn

- Option to Sell Shares

Call Our Business Specialists: (866) 797-9938

Trustpilot

Protect your personal assets and reduce your self-employment taxes. Our specialists review every detail for accuracy and compliance.

- Reduce Self-Employment Taxes

- Avoid Double Taxation

- Keep More of What You Earn

- Option to Sell Shares

Call Our Business Specialists: (866) 797-9938

As Seen On: Forbes, Entrepreneur, Inc., Business Insider • 600,000+ businesses served

Launch Your S Corporation in 3 Simple Steps

Share Your Details

Provide your business name and state, then choose the S Corporation package that fits your goals. Add helpful tools to stay compliant.

We Handle the Filing

Our specialists prepare and submit your formation documents to the state, ensuring everything is accurate.

Your S Corporation is Official

Once approved, you’ll receive your official formation documents so your S Corporation is recognized and ready for business.

Choose Your Corporation Package

Our attorney-crafted packages meet the compliance, filing speed, and support your LLC needs — all in one place.

Perfect for DIYers who just want the essentials.

We'll handle the paperwork – customize as you go.

Benefits:

We'll confirm your business name is available.

Real help from real humans – top-rated support through phone, chat, or email.

Personalized tax-saving tips from a 1-800 Accountant consultant

Smart choice for those who want speed and peace of mind.

Launch faster and stay compliant from day one.

Benefits:

Everything in Basic, plus more peace of mind.

EIN registration so you can open a bank account, hire employees, and start operating.

Compliance monitoring to help you meet state deadlines and avoid penalties.

Professional operating agreement - protects you if things go sideways, ideal for multiple owners.

Best for busy founders who want it all done right.

Expert legal support, privacy protection, and our fastest turnaround.

Benefits:

Everything in Standard, plus more value.

Skip the lawyer fees, 2 months of unlimited attorney consultations and customizable legal contracts.

Hassle-free LLC updates – handled at no extra cost.

Privacy protection with a professional business address you can use anywhere.

Why 600,000+ Owners Trust Swyft Filings

Get a direct line to business formation experts, available 7-days a week by phone or chat. Call (877) 777-0450. We love to help!

S Corp Election: Is It Right for Your Business?

Choosing the right structure and tax election can impact how much you keep from your profits. Here’s a clear comparison to guide your decision.

Choose an S Corporation if:

• Your business consistently generates $60,000+ in annual profits

• You can pay yourself a reasonable salary (often 40-60% of profits)

• You want to reduce self-employment taxes on distributions

• You’re comfortable managing payroll and compliance requirements

• You have predictable income that supports regular salary payments

• You want to optimize taxes while keeping business flexibility

• Your business meets IRS eligibility rules (no more than 100 U.S. shareholders and one class of stock, all shareholders must be U.S. citizens or residents)

Choose an LLC if:

• Your business profits are typically expected to be under $60,000 per year

• Your income is highly variable or seasonal

• You prefer simpler tax filing and bookkeeping

• You want to avoid payroll requirements and extra compliance

• You reinvest most profits back into the business

• You value operational simplicity over tax optimization

Ready to Get Your S Corporation?

Our specialists provide the clarity and filing support you need to compare options and move forward with the structure that fits your business.

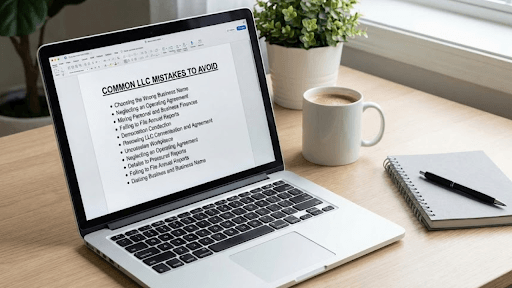

Related Articles

Managing an LLC: Compliance, Maintenance & Operating Agreement Essentials

Swyft Filings

Feb 2, 2026

Learn how to manage your LLC, maintain compliance, track finances, use an operating agreement, and handle member changes to protect your business and stay in good standing.

Join 600,000+ Business Owners Who Trust Swyft.

Hear from business owners who have used our platform to launch, grow, and manage their companies with confidence.

Incorporate with S Corp Status in Any State

An S Corporation election is a federal tax election that applies nationwide. While state tax implications and filing requirements may vary, you can become an S Corporation regardless of where your business is located. We provide expert guidance for businesses in all 50 states to ensure your S Corporation is filed correctly.

Alabama

Alaska

Arizona

Arkansas

California

Colorado

Connecticut

Delaware

Your S Corporation Questions, Answered

Here are answers to common questions about S Corporations.

Your S Corporation Questions, Answered

Here are answers to common questions about S Corporations.