Trustpilot

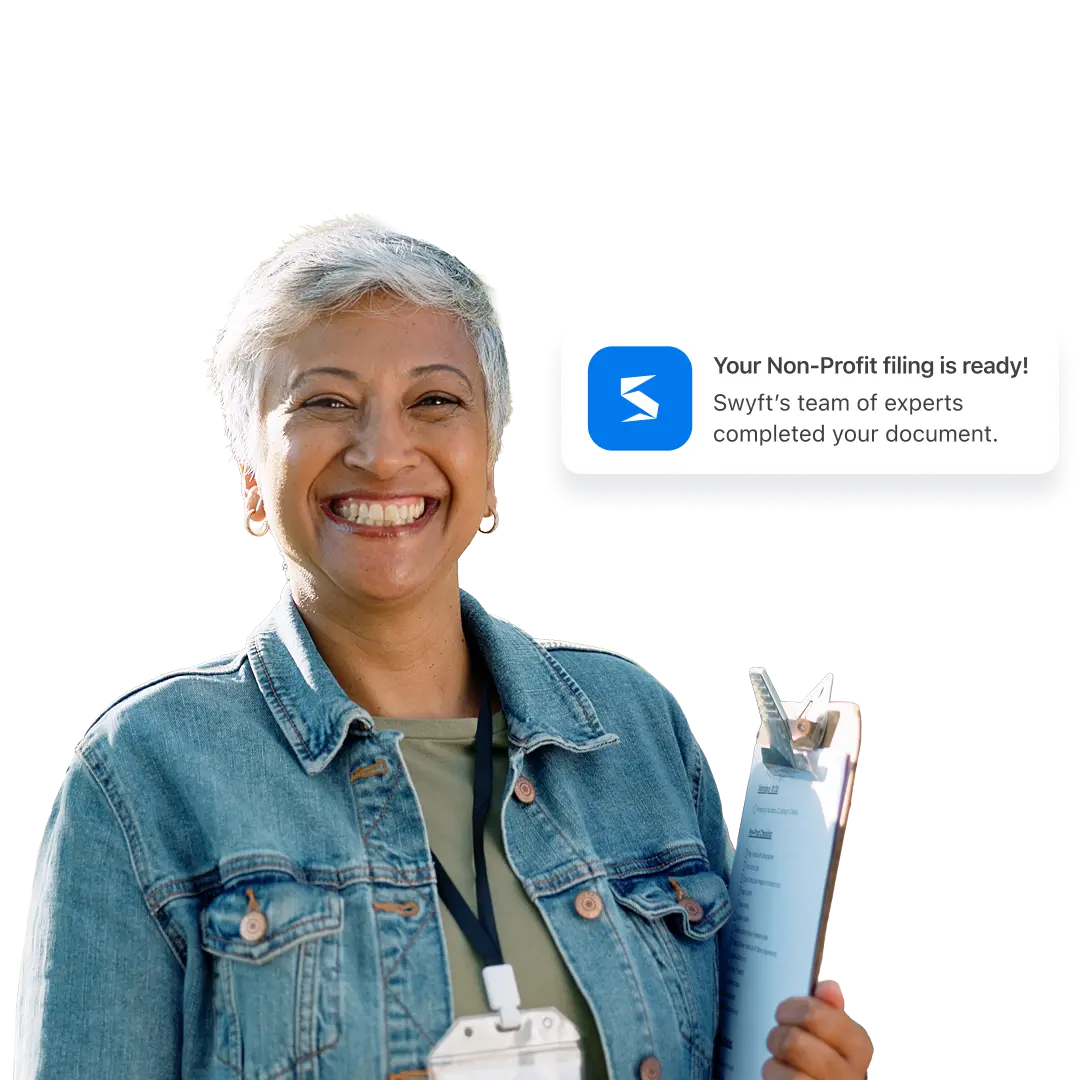

Turn Your Mission into a Recognized Nonprofit

Form your nonprofit with confidence. Our specialists review every detail for accuracy and compliance, ensuring your organization has the strongest foundation to apply for tax-exempt status.

- Tax-Exempt Ready

- Specialist-Reviewed

- State & IRS Compliant

- Trusted by 600,000+

Call our Business Specialists: (866) 797-9938

Trustpilot

Form your nonprofit with confidence. Our specialists review every detail for accuracy and compliance, ensuring your organization has the strongest foundation to apply for tax-exempt status.

- Tax-Exempt Ready

- Specialist-Reviewed

- State & IRS Compliant

- Trusted by 600,000+

Call our Business Specialists: (866) 797-9938

As Seen On: Forbes, Entrepreneur, Inc., Business Insider • 600,000+ businesses formed

Launch Your Nonprofit in 3 Simple Steps

Share Your Mission Details

Provide your nonprofit name, state, and details. Add tools like bylaws or an EIN to set your organization up for success.

We Handle the Filing

Our specialists prepare and file your nonprofit formation documents with the state, ensuring everything is accurate.

Your Nonprofit is Official

Once approved, you’ll receive your formation documents, so your nonprofit will be recognized and ready to pursue its mission.

Choose Your Nonprofit Formation Package

Our attorney-crafted packages meet the compliance, filing speed, and support your LLC needs — all in one place.

Perfect for DIYers who just want the essentials.

We'll handle the paperwork – customize as you go.

Benefits:

We'll confirm your business name is available.

Real help from real humans – top-rated support through phone, chat, or email.

Personalized tax-saving tips from a 1-800 Accountant consultant

Smart choice for those who want speed and peace of mind.

Launch faster and stay compliant from day one.

Benefits:

Everything in Basic, plus more peace of mind.

EIN registration so you can open a bank account, hire employees, and start operating.

Compliance monitoring to help you meet state deadlines and avoid penalties.

Professional operating agreement - protects you if things go sideways, ideal for multiple owners.

Best for busy founders who want it all done right.

Expert legal support, privacy protection, and our fastest turnaround.

Benefits:

Everything in Standard, plus more value.

Skip the lawyer fees, 2 months of unlimited attorney consultations and customizable legal contracts.

Hassle-free LLC updates – handled at no extra cost.

Privacy protection with a professional business address you can use anywhere.

Why 600,000+ Owners Trust Swyft Filings

Get a direct line to business formation experts, available 7-days a week by phone or chat. Call (877) 777-0450. We love to help!

Nonprofit vs. For-Profit: Which is Right for You?

Our specialists provide the clarity and filing support you need to compare options and move forward with the structure that fits your business.

Choose a Nonprofit if:

• Your primary purpose is charitable, educational, or religious

• You want to accept tax-deductible donations from supporters

• You need access to grants and foundation funding

• You want federal and state tax-exempt benefits

• Your mission serves the public good, not private interests

• You’re comfortable with restrictions on political activities

Choose an LLC if:

• You want to generate profit for owners or members

• You need maximum flexibility in business operations

• You plan to distribute earnings to owners

• You want the freedom to engage in political activities

• You prefer simpler ongoing compliance requirements

• You’re focused on commercial business activities

Ready to Get Your Nonprofit?

Our formation specialists give you the clarity and resources to compare options and move forward with the structure that fits your mission.

Related Articles

7 LLC Compliance Mistakes Every U.S. Business Owner Should Avoid

Swyft Filings

Feb 12, 2026

LLC compliance is crucial to avoid penalties. Simple habits like setting reminders and reviewing state requirements can prevent common mistakes.

Join 600,000+ Business Owners Who Trust Swyft.

Hear from business owners who have used our platform to launch, grow, and manage their companies with confidence.

Your Nonprofit Questions, Answered

Here are answers to common questions about forming a Nonprofit

Your Nonprofit Questions, Answered

Here are answers to common questions about forming a Nonprofit

![Top 13 Common Mistakes To Avoid When Forming an LLC [2026 Guide]](https://www.swyftfilings.com/assets/Forming_an_LLC_df1e8aee12.png)