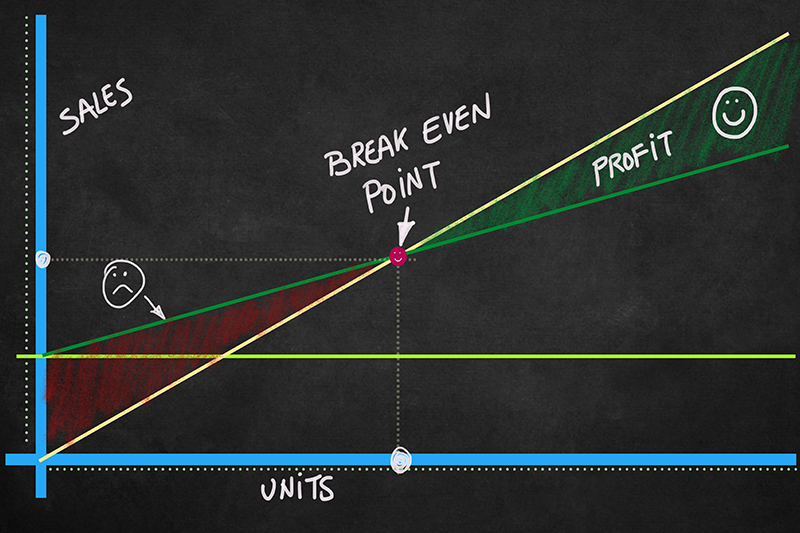

At first glance, merely breaking even may not seem like much of a business accomplishment, but it's a benchmark worth noting. For the beginning small business owner, your break-even point provides you with vital information about how your company is doing. When you break even, you're not making or losing money, but your costs are covered.

A break-even point is when what you're earning covers your production spending. Your revenue covers the labor, materials, and direct costs of creating your product. Your break-even point provides you with vital information to plan long-term strategy, including what you need to earn to make a profit. You can obtain this information with a break-even analysis.

What Is a Break-Even Analysis?

A break-even analysis provides you with the information you require to earn back your initial investment. It's a useful tool to determine when your business will be profitable. This information will inform you how much of your products and services you need to create and sell to cover your costs.

Finding your break-even point lets you know how many of your products you need to sell to pay for the materials required to make them. You might find that you need to move a lot more than you thought before covering costs. This gives you the opportunity to review your business model closely. Maybe you need to charge more or cut production costs to make a profit in the future.

Break-Even Analysis Formula

There is a formula used to calculate your break-even point. To understand the formula, it helps to know a couple of terms.

Fixed Costs

Fixed costs are expenses that remain the same month to month, regardless of how much you sell. Examples include insurance, rent, utilities, and administrative assistance costs.

Variable Costs

Variable costs are expenses that fluctuate along with sales. These can include labor, commissions, raw materials, and shipping.

The Formula

To find your break-even point, subtract your per-unit variable costs from your per-unit selling price. Divide your fixed costs by this number. That will tell you how many units you need to sell to break even.

Fixed Costs / (Average Price — Variable Costs) = Break-Even Point

We'll run through an example. Let's say you sell Wonder Widgets for $5 each. Your fixed costs are $2,000 for the month, and it costs $1 to produce each widget.

Fixed Costs = $2,000

Variable Costs = $1 per widget

Sales Price = $5 per widget

The formula would look like this:

$2000 ÷ ($5 - $1)

or $2000 / $4

That equals 500, meaning you would need to sell 500 Wonder Widgets that month to break even. If you move less than that, you're losing money. Sell more and you're making a profit.

Why a Break-Even Analysis Is Important

Knowing your break-even point can help you improve your business. After running the numbers, you may find that you need to make adjustments. A break-even analysis helps you set your budget, monitor and control costs, decide pricing strategy, and even motivate your employees.

When you look closely at your break-even analysis, you may find that you need to sell many more products than you currently are to break even. This is a good time to ask yourself if your current business plan is solid or faulty. You might need to raise prices, cut costs, or both.

When to Conduct a Break-Even Analysis

Ideally, it would be good to conduct a break-even analysis before you even start your business. That will give you a good idea of how much risk you are going up against. It's much easier to make some tweaks to your business plan at that early stage.

If you run an existing business, it's advisable to conduct a break-even analysis before launching a new product or service. This will let you know if the potential profit is worth the costs.

A break-even analysis is also a good idea if you add a new sales channel, such as expanding to selling online. The sales figures and costs will be different for an online sales channel than in a brick-and-mortar location. You'll want to make sure that your online venture will also break even. If it doesn't, the losses could put your entire business in jeopardy.

Additionally, it's prudent to conduct a break-even analysis when you change your business model. Small adjustments in how you run things can have a big effect on whether your company is making money.

How Conducting a Break-Even Analysis Benefits Your Business

Here are several ways that conducting a break-even analysis can benefit an existing business.

Pricing

Your analysis could show that your current pricing structure is too low to enable your company to break even. This gives you the opportunity to raise prices. But before you bust out the pricing gun, do some research on what your competitors are charging so that you don't price yourself out of the market.

New Products

New product launches are usually a time of much excitement for a business. Don't let that excitement blind you to possible issues. A break-even analysis before launching can let you know if your new product, along with its new promotion and design costs, is truly a good idea for your business.

Materials and Labor

If you haven't broken even yet, it could be that the cost of your materials and labor is too high. This makes your business model unsustainable. If this is the case, research ideas for lowering costs while maintaining the quality of products and services.

Planning

Knowing exactly how much your company needs in terms of revenue helps you plan for reaching your business goals. This can help to motivate you and your employees. For example, if you wish to move into a larger office building, a break-even analysis lets you know how much you need to sell to make that worth it.

Break-Even Analysis Limitations

Like all business planning tools, a break-even analysis can only go so far. Here are several limitations:

Won't Predict Demand

Demand fluctuates. A break-even analysis can tell you what your sales have been, but it can't tell you what your sales will be. You will only learn how many units of your product you need to sell to break even.

Requires Reliable Data

The concept "garbage in, garbage out" applies to a breakdown analysis. The data you provide must be reliable. Ensure that all calculations are correct by double and even triple-checking your data before plugging it into the equation.

Provides a Limited View

A break-even analysis gives you an overarching look at your business. It isn't going to pick up on the specifics and nuances of running a profitable business.

Only Looks at the Present

The break-even analysis doesn't take the future into account. You will see only present trends. That means if costs rise considerably for the materials to make your products in the future, your company may no longer be in break-even status.

Doesn't Account for Competitors

Your business will affect your competitors' business. If you're already struggling, the last thing you need is a price war. This kind of activity could severely disrupt your break-even point.

A Useful Tool

Despite the limitations, a break-even analysis is an essential skill for every small business owner. It helps you make smart, informed decisions and take the right steps to ensure your business stays profitable. Whether you're running the world's largest Wonder Widget warehouse or hawking handmade handkerchiefs on Etsy, a break-even analysis is a handy tool in your small business bag of tricks.

---

A break-even analysis for your business gives you a solid understanding of your business's baseline conditions, which helps you be successful. To learn more about what you can do to increase your business's chances of success, visit Swyft Filings' Learning Center.