Learn how to avoid LLC administrative dissolution with a simple compliance checklist, plus steps to dissolve or reinstate your business if needed.

Key Takeaways:

Stay compliant by filing reports, paying taxes, and maintaining a registered agent to avoid administrative dissolution.

To dissolve, vote, settle debts, file paperwork, and submit final tax returns.

Inactive LLCs can still incur fees and obligations.

Reinstating a dissolved LLC requires fixing missed filings, paying penalties, and submitting paperwork.

Running an LLC comes with a lot of responsibilities, and one of the most serious challenges you could face is administrative dissolution. Your LLC can lose its legal status if you:

- Miss critical compliance deadlines

- Fail to file annual reports

- Not pay state-required fees

This can further lead to fines, missed opportunities, and even business shutdowns.

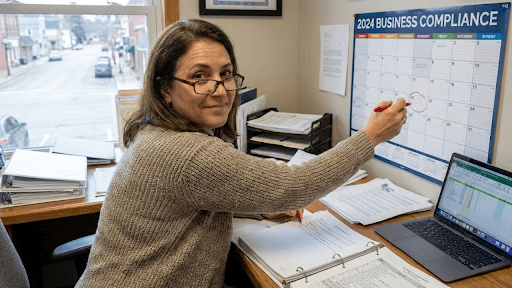

Many entrepreneurs juggle multiple tasks and deadlines, which makes it challenging to understand the compliance requirements.

This guide will walk you through a simple compliance checklist to ensure you meet all your legal obligations.

What Does LLC Dissolution Mean?

It is the official, legal process of ending a LLC’s existence with the state. It is part of the lifecycle of a business, which involves specific steps, including:

- Vote to close

- Notify creditors

- Settle debts

- File final paperwork

- Complete any state-required filings

Once dissolved, the LLC ceases regular business and enters a “winding up” phase to wrap up affairs and distribute assets.

NOTE: Without proper dissolution, your LLC may still be seen as active, leaving you responsible for ongoing reports, fees, and potential liabilities.

Administrative vs. Judicial Dissolution

Administrative Dissolution | Judicial Dissolution | |

What It Is | When the state dissolved your LLC for failing to meet legal requirements (like missing reports, taxes, or a registered agent). | When a court orders the dissolution of your LLC due to serious legal or internal issues. |

How It Happens | The state issues a notice, and if the issues aren’t fixed, it dissolves the LLC. | A lawsuit is filed, and the court decides whether or not to dissolve the LLC. |

Triggered By | Non-compliance with state rules (missed reports, unpaid fees, etc.). | Member disputes, deadlocks, fraud, mismanagement, or insolvency. |

Consequences | The LLC loses rights to operate, can’t defend lawsuits, and legal protections weaken. | LLC loses rights to operate, may not defend lawsuits, and protections weaken. |

What Causes Administrative Dissolution of an LLC?

An LLC faces administrative dissolution mainly for failing to meet state-mandated compliance, such as:

- Failure to file annual/biennial reports: Not submitting required periodic reports to the Secretary of State.

- Non-payment of fees/taxes: Missing due dates for state franchise taxes, annual fees, or other penalties.

- No registered agent/office: Lapsing on the requirement to have a designated registered agent or registered office in the state.

- False filings: Submitting documents with intentionally false information.

- Non-compliance with state laws: General failures to adhere to other state-specific regulations.

The Good Standing Checklist to Avoid LLC Penalties

Step-By-Step Compliance Checklist

- Track your annual report deadline (set reminders 30–60 days ahead).

- Keep a registered agent active and update changes quickly.

- Confirm state tax and fee items (including franchise taxes where applicable).

- Keep basic company records organized (members, managers, addresses, EIN, licenses).

- Pull a Certificate of Good Standing when needed (for banks, vendors, state registrations).

Inactive LLCs: Stay Compliant or Dissolve?

Whether to keep an inactive LLC compliant or dissolve it depends on various factors such as:

- Goals

- State requirements

- Associated costs

Here is the breakdown of the pros and cons of both options:

Staying Compliant (Keeping the LLC Active)

Pros

- Preserve the structure of your LLC.

- The LLC structure continues to protect your personal assets from business debts and liabilities.

- The LLC dissolution could complicate the situation if your LLC has established credit or entered into contracts.

Cons

- Most states require LLCs to file annual reports and pay fees. These costs can add up even when no business activities are taking place.

- You might still need to file annual tax returns even if no income is being generated. This could involve fees and additional administrative work.

- Failing to file the necessary documents or pay the required fees may lead to penalties or administrative action.

LLC Dissolution

Pros

- Once dissolved, the LLC is no longer required to file annual reports or pay maintenance fees.

- Dissolution removes any administrative responsibilities related to maintaining the LLC

Cons

- You will no longer have personal asset protection from business liabilities.

- You may face difficulty restarting, as you have to cover additional costs, paperwork in forming a new LLC.

- LLC dissolution may involve closing out taxes and filing a final return, depending on the state and your LLC’s financial situation.

Step-by-Step: How to File Dissolution of an LLC

Here is the step-by-step process to file the dissolution of an LLC:

1. Review Operating Agreement

Check your LLC’s operating agreement (if you have one). This document may outline the steps and procedures for dissolution, including member voting requirements or special instructions. Follow state laws if there is no operating agreement.

2. Vote to Dissolve

Hold a formal meeting (if multi-member) and record the decision in meeting minutes or written consent. In most cases, LLC members must approve the dissolution. The operating agreement specifies the necessary vote required to dissolve.

3. File Articles of Dissolution

Submit the required forms (Articles of Dissolution) to your state’s Secretary of State. Download the appropriate form from your state’s Secretary of State website. There is usually a filing fee, which varies by state. Check the state’s website for the current fee. You will need to provide basic information such as:

- LLC name

- LLC’s business ID number (or EIN)

- Date of dissolution approval (if different from filing date)

- A statement confirming that all LLC debts and obligations are settled (in some state)

Many businesses use online services that help with business dissolution, from filing Articles of Dissolution to providing proof of closure. This saves time and makes the process efficient.

4. Notify Creditor and Settle Debts

Inform all known creditors, customers, and stakeholders. Pay off or establish reserves for all liabilities and obligations. If the LLC has assets, they should be liquidated to pay off any debts. Distribute any remaining assets according to the LLC’s operating agreement.

5. File Final Taxes and Get Tax Clearance

File final federal (IRS) and state tax returns. Check the “final return” box and obtain tax clearance if required by your state.

6. Cancel Licenses and Registrations

Close business bank accounts, cancel permits, licenses, and any assumed names (DBAs).

7. Keep Records

Maintain copies of all dissolution documents, tax filings, and meeting records.

NOTE: Check your Secretary of State’s website, as requirements vary by state.

Step-By-Step: How To Reinstate an Administratively Dissolved LLC

1. Contact the Secretary of State (SOS)

Visit your state’s SOS website or call them to find specific forms, fees, and requirements for reinstatement, as these vary by state.

2. Cure the Cause of Dissolution

Address the reason for dissolution, usually to file annual reports or pay fees/taxes.

3. Gather and Complete Forms

- Fill out the official LLC reinstatement application.

- Complete all overdue annual reports.

- Ensure you are updating information like your registered agent or address if needed.

4. Pay All Fees and Penalties

Pay delinquent annual fees, franchise taxes, penalties, and the reinstatement fee, which can be significant.

5. Submit and Await Approval

File your application and documents (often online, but sometimes by mail) and wait for the state to process and approve your reinstatement.

6. Verify Reinstatement

Once approved, ensure your business is listed as “Active” or “In Good Standing” and update any other relevant government records.

Need Help with LLC Compliance or Dissolution?

Swyft Filings can simplify the process of dissolving your LLC, reinstating a dissolved business, or staying compliant with state regulations. One of our experienced agents can walk you through the steps so that you can focus on growing your business.

Frequently Asked Questions (FAQs)

1. What does the dissolution of an LLC mean?

It is the legal process of formally ending the existence of the LLC as a business entity. It involves ceasing all business activities, settling any debts and obligations, and officially closing the business with the state and federal authorities.

2. What causes the administrative dissolution of an LLC?

Here are the causes of administrative dissolution of an LLC:

- Failure to file annual reports

- Unpaid taxes

- No registered agent

- Failure to respond

3. What happens if your LLC does not file an annual report?

You will face late fees and penalties, and lose your good standing status.

4. Can an LLC be inactive and still owe fees or filings?

Yes, an LLC can be inactive and still owe significant fees, taxes, and filing obligations.

5. What are the IRS steps when closing a business?

The IRS requires you to file final tax returns, pay all outstanding taxes, handle employee payroll and taxes, report payments to contractors, and formally close your IRS account by sending a letter to cancel your Employer Identification Number (EIN).