Excellent

Start Your Alabama LLC with Confidence

Excellent

As seen in

How to Start Your Alabama LLC: 5 Essential Steps

We make forming your Alabama LLC straightforward and worry-free. Here's exactly what you'll do and what it costs – no hidden fees, no surprises.

Your Formation Journey

Alabama LLC costs broken down – state, county, annual fees. Special Requirements: Alabama's unique two-filing process requires name reservation first, then county filing.

Reserve Your Business Name

Alabama requires name reservation before filing. We'll check availability and secure your name.

Appoint Your Registered Agent

Every Alabama LLC needs someone to receive legal documents. You can do this yourself or use our professional service.

File with County Probate Court

Unlike most states, Alabama files through county courts. We handle the entire two-step process for you.

Create Your Operating Agreement

Define how your business runs. While not required, it's essential for protecting your limited liability.

Get Your EIN

Your federal tax ID number – it's free from the IRS and required for banking and taxes.

Complete Cost Breakdown

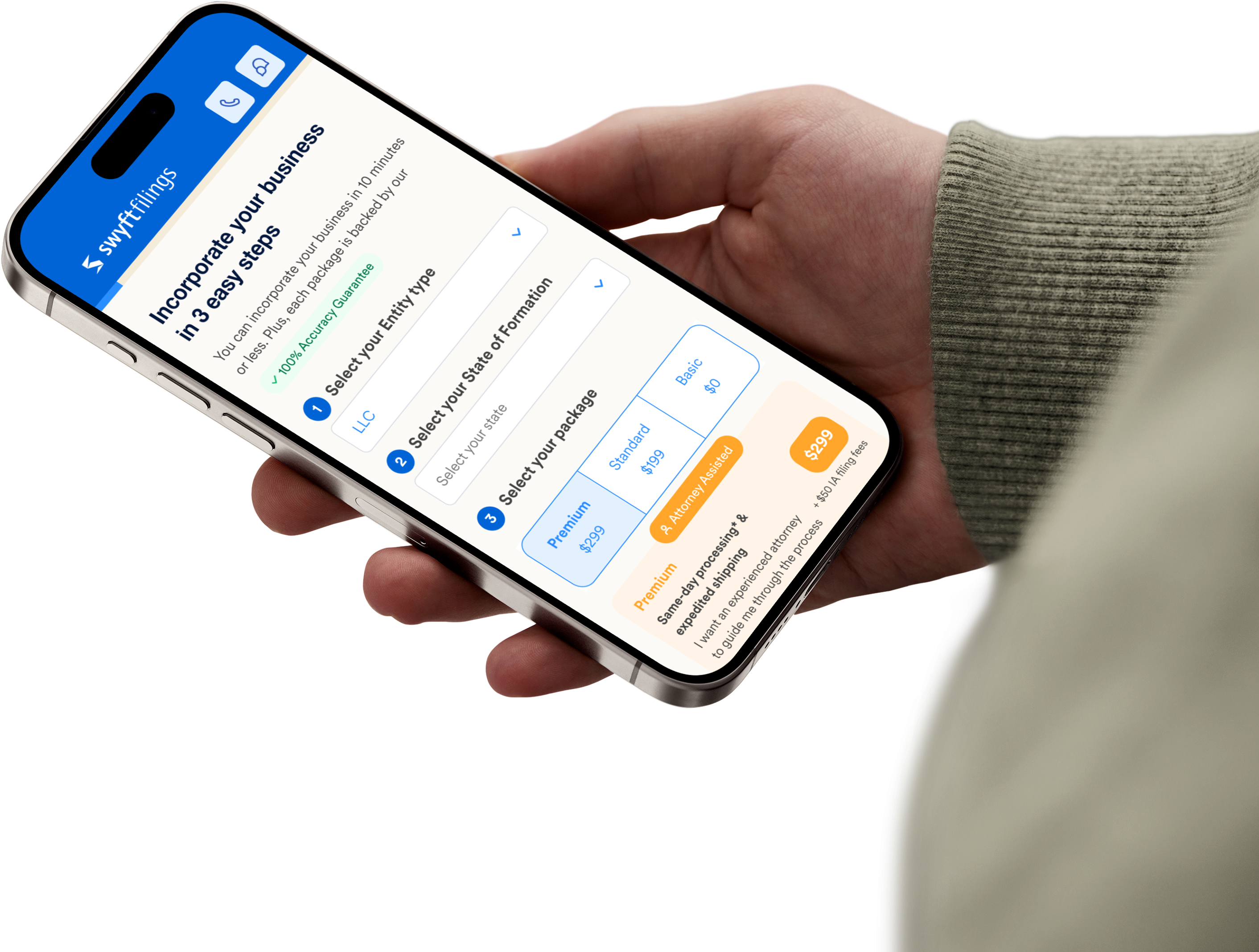

Choose Your Alabama LLC Formation Package

Every package includes specialist review and live support – because getting it right the first time saves time and money.

Perfect for DIYers who just want the essentials

Benefits:

We'll confirm your business name is available

Real help from real humans – top-rated support through phone, chat, or email

Personalized tax-saving tips from a 1-800 Accountant consultant

Smart choice for those who want speed and peace of mind

Benefits:

Everything in Basic, plus more peace of mind

EIN registration so you can open a bank account, hire employees, and start operating

Compliance monitoring to help you meet state deadlines and avoid penalties

Professional operating agreement - protects you if things go sideways, ideal for multiple owners

Best for busy founders who want it all done right

Benefits:

Everything in Standard, plus more value

Skip the lawyer fees, 2 months of unlimited attorney consultations and customizable legal contracts

Hassle-free LLC updates – handled at no extra cost

Privacy protection with a professional business address you can use anywhere

Your Alabama LLC Questions Answered

Your Alabama LLC Questions Answered

Alabama LLC vs. Corporation: Which Is Right for You?

Most Alabama small businesses choose LLCs for simplicity and flexibility. Here's an honest comparison to help you decide.

LLC

Maximum flexibility in management structure

• You can structure your LLC however you want, with members managing directly or appointing managers

Pass-through taxation to avoid double taxation

• LLC profits and losses pass through to members' personal tax returns, avoiding corporate double taxation

Simpler compliance with fewer formalities

• No required board meetings, corporate minutes, or complex record-keeping requirements

Lower annual maintenance costs

• Minimal state filing requirements and lower ongoing compliance costs

Ideal for small businesses, consultants, or property owners

• Perfect structure for most small businesses that value operational simplicity

Corporation

Ability to raise venture capital or go public

• Corporations can issue stock to investors and eventually go public on stock exchanges

Multiple classes of stock for investors

• Issue different types of stock with varying rights and preferences for different investor groups

Stock option plans for employees

• Attract and retain talent with employee stock option plans and equity compensation

Established corporate structure for credibility

• Traditional corporate structure with board of directors provides institutional credibility

Easier ownership transfers via stock sales

• Ownership can be easily transferred by selling shares without disrupting business operations

Still unsure about the right choice for your business?

Our business formation specialists understand Alabama requirements and can help you choose the structure that fits your goals.

What to Do After Forming Your Alabama LLC

Once your LLC is officially formed, these essential steps ensure you maintain compliance and set your business up for long-term success.

Open Your Business Bank Account

Separate your business and personal finances immediately to maintain your LLC's liability protection. This separation is crucial because mixing funds (called "commingling") can jeopardize your limited liability status in court. You'll need your EIN confirmation letter, Certificate of Formation, and operating agreement to open the account.

File Your Initial Business Privilege Tax

Submit your initial Business Privilege Tax return within 2.5 months of formation with a minimum payment of $100. This tax is Alabama's unique requirement that replaces traditional annual reports in other states. Missing this deadline results in penalties ranging from $50-$500 and potential administrative dissolution.

Get Required Business Licenses

Secure all necessary local and industry-specific licenses before conducting business. Most Alabama businesses need at least a city or county business license, and many require additional permits based on your business type. Operating without proper licenses can result in fines, business closure, and inability to enforce contracts.

Maintain Your Registered Agent

Keep your registered agent information current and ensure continuous service. Your registered agent receives all legal documents and state correspondence on behalf of your LLC. Any changes to your registered agent must be filed with the Alabama Secretary of State, and a lapsed agent can result in missed legal notices and default judgments.

Track Your Expenses

Maintain detailed records of all business income and expenses from day one. Proper record-keeping not only protects your limited liability status but also maximizes tax deductions and simplifies annual tax preparation. Poor records can lead to disallowed deductions and increased audit risk.

File Annual Business Privilege Tax

Submit your annual Business Privilege Tax return by April 15 each year, even if you owe no additional tax beyond the $100 minimum. This filing keeps your LLC in good standing with the state. Failure to file can result in administrative dissolution and loss of your business's legal protection.

Your Complete Alabama LLC Setup Guide

Your Complete Alabama LLC Setup Guide

Official Alabama Business Resources

Use this directory of official state resources to stay compliant and find support for your Alabama business.

Official Alabama Business Resources

State Resources - Official Alabama Business Resources

Critical Alabama LLC Formation Errors That Cost Time and Money

Critical Alabama LLC Formation Errors That Cost Time and Money

Stay Current with Alabama Business Updates

Get exclusive Alabama business insights delivered monthly including Business Privilege Tax changes and deadlines, new legislation affecting Alabama LLCs, local incentive programs and grants, plus success stories from Alabama business owners.